Fraud & Taxes: What You Need To Know About Unemployment Benefits

Are you meticulously tracking your income and tax obligations? Understanding the intricacies of your 1099-G form, particularly when it comes to unemployment benefits, is not merely a good practice; it's a critical necessity for accurate tax filing and avoiding potential penalties.

Navigating the complexities of unemployment benefits and the associated tax implications can feel like traversing a labyrinth. This piece aims to demystify the process, providing clarity on the 1099-G form, how to obtain it, its importance, and, crucially, how to protect yourself from fraud. The Colorado Department of Labor & Employment (CDLE) plays a significant role in this process, and understanding their procedures is key. The information provided is intended to be a helpful guide, remember that it is always best to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

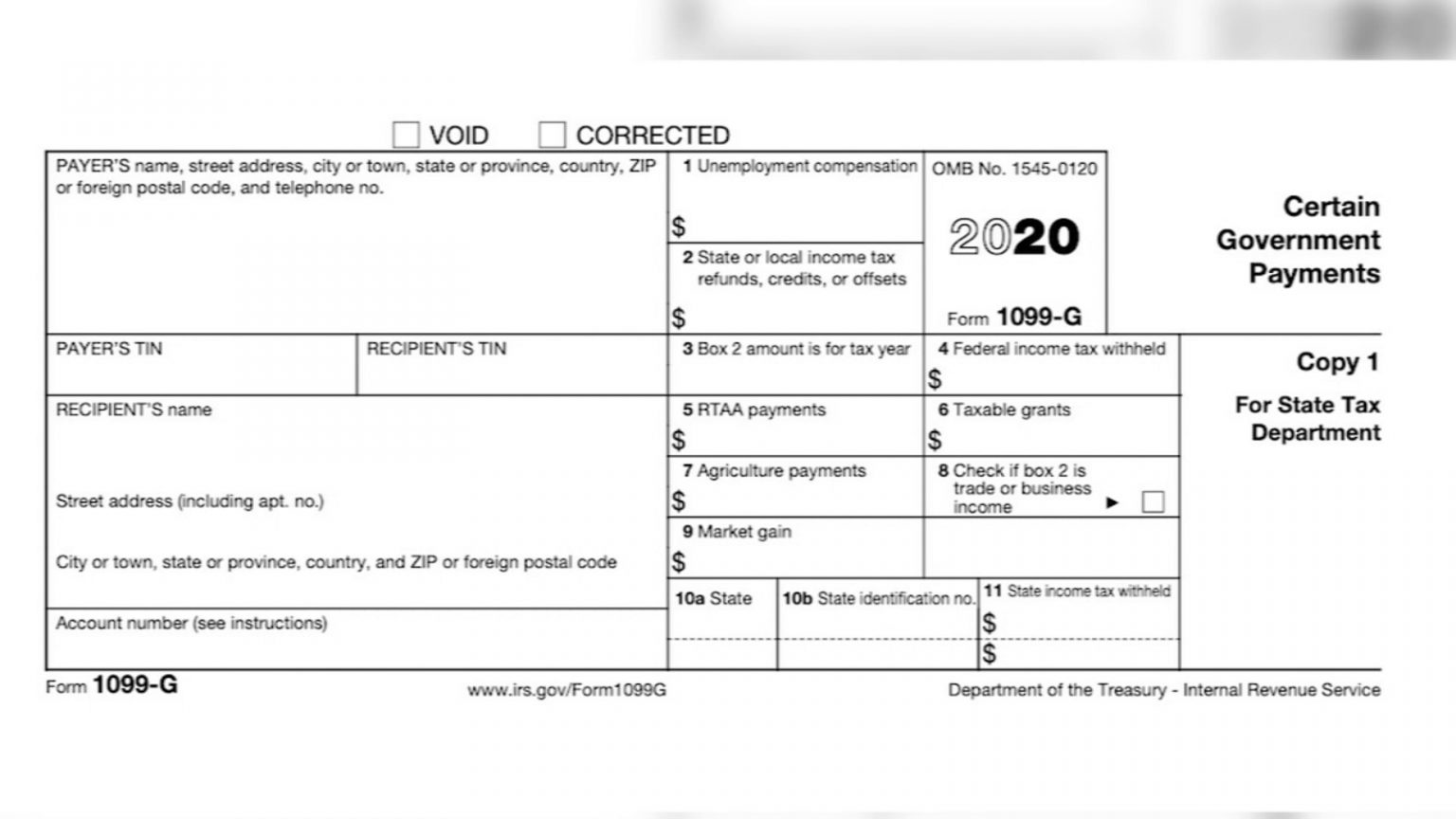

The 1099-G form, in essence, is your annual record of unemployment compensation received. It's a vital document for anyone who received unemployment benefits during the previous tax year. This form details the total amount of benefits you were paid and, if you opted to have income tax withheld, the amount that was withheld. It is essential because unemployment benefits are considered taxable income by the federal government.

Let's examine a hypothetical individual, let's call him John Smith, and see how this unfolds. He was a seasoned marketing professional in Denver, Colorado, who unfortunately faced job displacement. John diligently applied for and received unemployment benefits through the CDLE. The 1099-G form became a central piece of his tax filing process. It would show the total amount of unemployment compensation he received throughout the year. This is what he needs to file his federal taxes.

| Category | Details |

|---|---|

| Full Name | John Smith |

| Date of Birth | July 15, 1978 |

| Address | 123 Main Street, Denver, CO 80202 |

| Career | Marketing Professional |

| Previous Employer | Tech Solutions Inc. |

| Unemployment Benefit Provider | Colorado Department of Labor & Employment (CDLE) |

| Tax Year (Example) | 2023 |

| 1099-G Form Issuing Agency | Colorado Department of Labor & Employment (CDLE) |

| Key Tax Filing Point | Report unemployment benefits as taxable income on federal and state tax returns. |

| Relevant Website Reference | Colorado Department of Labor & Employment (CDLE) |

The CDLE provides an online platform where individuals often have access to their tax forms. If you have an online account, this is the most likely place where you can view and download your 1099-G form. This offers a level of convenience, enabling you to access the necessary tax documents from the comfort of your home.

However, the process isn't always smooth sailing. There can be disruptions, for example, the Colorado unemployment system is sometimes unavailable for maintenance. The system might be down for a few hours usually between 10:00 PM and 3:00 AM Mountain Time. This is typically when they are performing essential updates and system maintenance. Make sure to check the CDLE website for the current operational status.

- Alice Rosenblum Leaks What You Need To Know Latest Updates

- Alice Rosenblum Updates Leaks Whats Trending Now

One of the most critical aspects of dealing with unemployment benefits is protecting yourself from fraud. It's important to be aware that fraudsters actively seek to exploit the system. They often steal or purchase private information from illicit data brokers and then file fraudulent unemployment claims. This underlines the importance of vigilance and prompt action if you suspect any fraudulent activity.

If you receive a 1099-G form and are uncertain about its accuracy, or you suspect a fraudulent claim has been filed using your information, you must report it immediately. Report any suspected fraudulent claims to the CDLE's fraud prevention department. The CDLE takes fraud seriously and has established processes for investigating such claims.

If you receive a corrected 1099-G form, it's crucial to wait to file your tax return until you receive it. The corrected form will have a clear indication that it's the updated version usually a checkmark on the top of the form. If the initial form was incorrect, the corrected form will also show the right information. For instance, if an error resulted in an overstatement of your unemployment compensation, the corrected form will rectify it, and potentially indicate $0 in the "unemployment compensation" box. This is essential to ensure you file accurate tax returns and avoid the need to amend your return later, which can be time-consuming and potentially expose you to penalties.

Knowing where to find the Employer Identification Number (EIN) and address for the 1099-G form from the state is also important for tax purposes. This information is required when you file your federal tax return. The CDLE's website or the 1099-G form itself will have this information. It ensures that your tax return is properly filed and that the IRS can match the income you reported to the income reported by the state.

For those who filed state income taxes, you can usually file online. The Colorado Department of Revenue offers online filing options for state income taxes. Online filing often provides a quicker, more efficient method of submitting your tax returns. This often leads to a faster processing time and faster refunds.

You can find your 1099-G form online if there is an online account where you manage your benefits. The process usually involves logging into your account on the CDLE website and navigating to the section that displays your tax forms. Once located, you can view and download the form, making it ready for tax filing.

In case of any overpayment, you might receive an overpayment letter or other information from the CDLE. You will likely need to address the overpayment, which could involve repayment or appealing the decision. Always read any correspondence carefully and follow the instructions provided by the CDLE. It's extremely important that you do not ignore correspondence from the CDLE, especially if it relates to potential overpayments or fraud.

Filing your state income taxes online streamlines the process. Online tax filing systems are often user-friendly and guide you through the steps, ensuring you report all necessary income and deductions. These systems often calculate your tax liability automatically and offer helpful instructions to walk you through each step of the process.

Keep in mind that unemployment benefits are considered taxable income. Therefore, the amount reported on your 1099-G form must be accurately reported on your federal income tax return. Failure to do so can lead to underpayment of taxes, interest, and possibly penalties.

The 1099-G form provides key details that you'll need for your federal tax return. It will specify the amount of unemployment compensation you received during the tax year. It also indicates if you had income tax withheld from your benefits. All this information helps you properly declare your income and calculate your tax liability.

Select the relevant tax year to view the document. When you access the CDLE website or your online account, you'll typically have the option to choose the tax year for which you need the 1099-G form. Select the correct tax year to ensure you are viewing the correct documentation.

There is a lot of information available that explains what details are included on the form, when you should expect to receive it, and how to report this income on your tax return. The CDLE and the IRS provide guides and resources to assist you. These resources aim to explain the forms layout, how to interpret the information, and how to accurately report the income on your tax return.

The labor department will send a corrected form with a checkmark on the top. It indicates that the initial form had an error and has been corrected. The corrected form ensures that you are filing with the correct financial information.

Thank you very much for your help. The CDLE and other agencies appreciate your cooperation and diligence. Their goal is to ensure that benefits are distributed fairly and accurately. Your active engagement in the process is a sign of your commitment to the financial process.

Detail Author:

- Name : Korey Herman

- Username : hiram16

- Email : beier.dameon@lakin.com

- Birthdate : 1976-12-01

- Address : 810 Caleb Inlet New Kylie, MO 69498-2026

- Phone : +1.747.612.8353

- Company : Dibbert Group

- Job : Surgical Technologist

- Bio : Explicabo ipsa asperiores occaecati cupiditate natus. Reiciendis rerum et totam aut nihil est sapiente. Accusamus saepe eum quas reprehenderit vitae.

Socials

instagram:

- url : https://instagram.com/karolann_real

- username : karolann_real

- bio : Sed voluptate nam adipisci quaerat repellendus repudiandae. Et repudiandae ipsa qui corporis et.

- followers : 1303

- following : 2920

twitter:

- url : https://twitter.com/dachk

- username : dachk

- bio : Commodi cumque exercitationem omnis rerum hic aut maiores. A perspiciatis repellat error quia.

- followers : 6053

- following : 1783